He pointed out that this represents a 16.13% growth compared to the same period, but from last year.

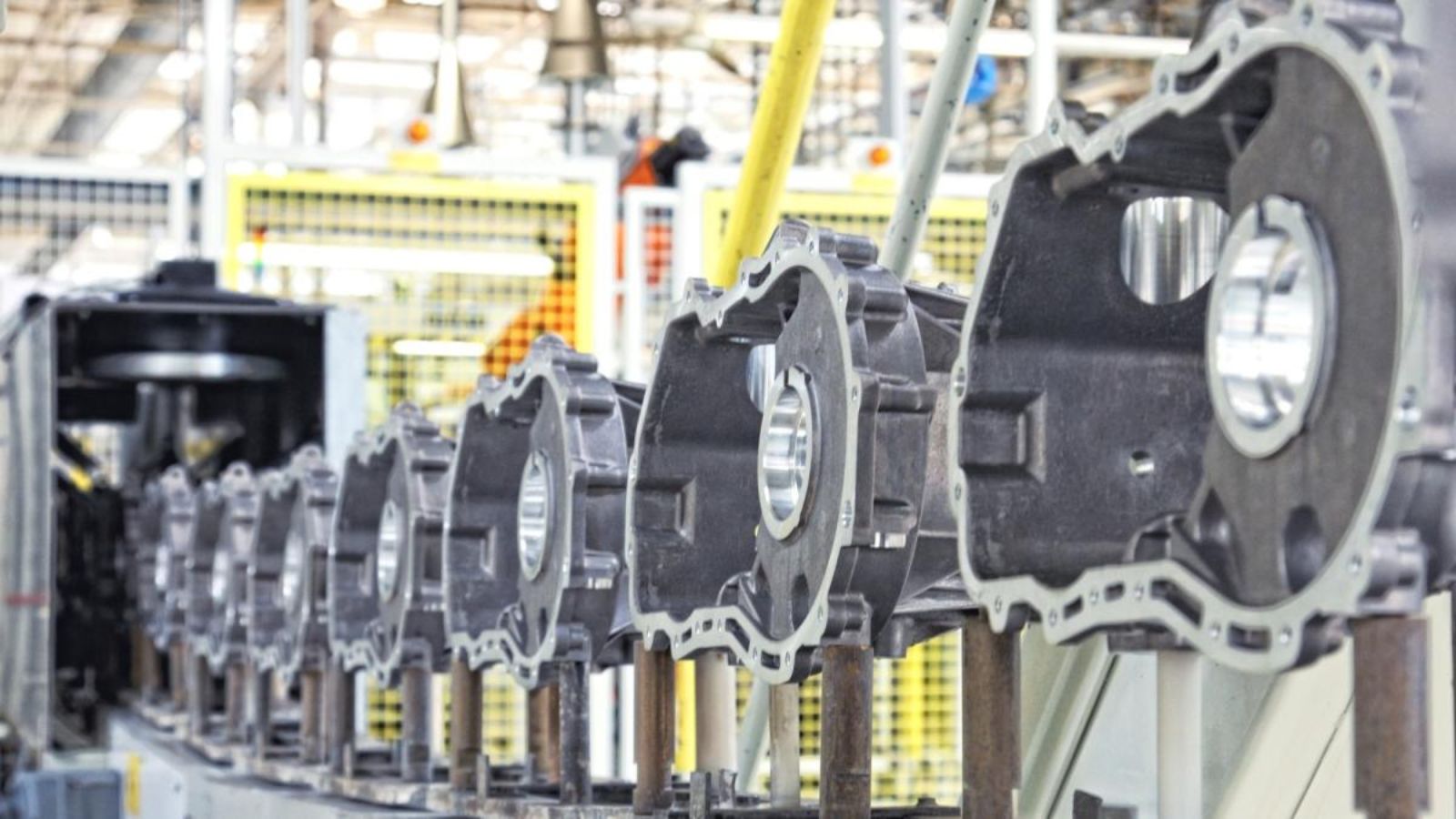

"We exceeded, but by far in the same period of pre-pandemic and post-pandemic, which reflects the consolidation of the Mexican auto parts industry as one of the world powers in terms of auto parts manufacturing," he pointed out.

Bustamante reminded that the forecast for the industry this year is to exceed 112 billion dollars.

He highlighted the northern region with close to 2% of total auto parts manufacturing, followed by the Bajío region, which exceeded 30%, and the central region with 15%.

The INA reported that Coahuila is the main auto parts producing state in Mexico, followed by Chihuahua, Nuevo León, Guanajuato, Querétaro, Tamaulipas and Estado de México.

Alberto Bustamante also explained Mexico's growth as the main supplier to the United States because it occupies close to 43% of U.S. imports of automotive components as of March 2023, over Canada (11%), China (7.4%), Japan (6.9%) and Germany (6%).

In terms of foreign direct investment (FDI) in Mexico he detailed that, during the first quarter of 2023, the participation of the United States represented around 67% for the auto parts sector, followed by Germany with 27.2% and the United Kingdom with 5.7%.

"Although in the cumulative from 1999 to 2023, the United States, Japan, Germany and Canada lead the list of nations with the highest FDI in Mexico's auto parts industry," he pointed out.

Jobs

The director general of INA emphasized that, in terms of employment, the auto parts industry has a historical record as of March of this year with more than 900,000 direct jobs.

"Which should be added to those indirect jobs generated in the more than 252 economic branches of the country (...), consolidating Mexico as the main generator of employment, not only in the manufacturing sector in our country but we are talking about all of North America," stressed the auto parts expert.